Providing reliable analysis for the retail investor

Financial Summary

We provide concise financial summaries that distill key information from a company’s financial statements and performance metrics. Our short financial summaries highlight essential figures, trends, and ratios, offering a clear snapshot of a company’s financial health. This approach enables investors to quickly grasp the most important aspects of a business’s financial position and make informed decisions efficiently.

Deep Dives

We conduct in-depth, comprehensive research into stocks, analyzing financial statements, industry trends, and company fundamentals. Our approach involves thoroughly examining both quantitative and qualitative factors to uncover investment opportunities and risks. By diving deep into each company’s business model and market environment, we aim to provide well-informed insights that support sound investment decisions.

Market Overview

We provide clear, focused overviews of market competition, highlighting the key players and dynamics within an industry. Our summaries identify major competitors, their market positions, and relevant strategies, giving investors a quick understanding of the competitive landscape. This approach helps inform investment decisions by revealing potential risks and opportunities arising from industry rivalry.

Our Global Portofolio

A global portfolio of stocks built on a fundamental approach emphasizes the careful selection of companies based on their intrinsic value, strong financial health, and sustainable business models. This strategy involves analyzing key factors such as revenue growth, profitability, balance sheet strength, competitive advantages, and management quality across various international markets and sectors. By focusing on fundamentals rather than short-term market fluctuations, the portfolio aims to capture long-term value and minimize the impact of volatility, currency movements, and economic cycles that can affect global equities.

Additionally, the portfolio is governed by a disciplined rule: investment ideas are held for a minimum of three years before being considered for sale. This restriction encourages a patient, long-term perspective and reduces the temptation to react to short-term noise or transient market events. By allowing investments sufficient time to realize their potential and the underlying thesis to play out, this approach aligns with the belief that true value is often unlocked over extended periods. The result is a focused portfolio designed to benefit from compounding returns and the enduring strengths of well-chosen companies across the globe.

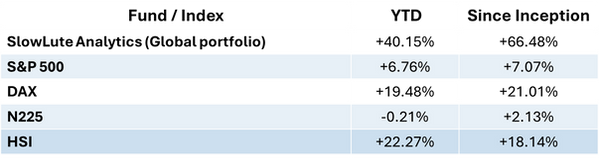

Global portfolio performance vs. SP500 (Since Inception*)

*Last update june/2025

*Portfolio Inception Nov/2024